- Boardspire

- Posts

- Are You Invisible to Tomorrow’s Biggest Deal-Makers?

Are You Invisible to Tomorrow’s Biggest Deal-Makers?

Using Digital Benchmarks to Transform Missed Connections into Meaningful Growth

Hey, it’s David

Today on M&A from the Plane, we’re gearing up for a different kind of flight, one into the world of digital transformation in private equity.

M&A from the Plane… Ready for the Digital Journey? Buckle Up.

Alright, imagine boarding a plane for a cross-country flight. You’ve got the jet, the fuel, and the coordinates, but here’s the problem…you don’t have a map or compass. You’d probably think twice before taking off, right? Yet, in private equity, that’s exactly how it feels navigating digital transformation without clear benchmarks.

Data benchmarks are your compass, your altimeter, your fuel gauge. Without them, you’re flying blind. Precise metrics in private equity may be rare, but the broader financial services industry gives us a point of reference, a kind of rough flight path.

Take email marketing. With an industry open rate of 27.1% , think of this as your minimum threshold. Every email that doesn’t engage is a missed connection, a lost opportunity for influence. Going below this isn’t just “missing the mark”, it’s a fundamental flaw in your engagement engine.

Website performance is another vital piece. Bounce rates average around 50% to 60%, with visitors spending about 2 to 3 minutes per session. If users are bouncing faster than that, it’s like losing them mid-flight, they boarded, but something about the experience sent them packing. Fixing this means optimizing your content, layout, and targeting.

Then there’s social media, the networking cockpit. LinkedIn engagement rates average around 0.54% . It sounds small, but each quality connection has exponential potential in private equity. Imagine each engagement as a strategic link in a chain that could yield deals, insights, and growth. A little can go a long way.

Paid search metrics show conversion rates around 2.9% . If your campaigns fall below that, you’re burning through resources inefficiently. Consider this like jet fuel; every ad dollar spent without a tangible return is another mile you can’t reach.

And then there’s Customer Acquisition Cost (CAC), that can range from $175 to $5,000+. High? Yes, but necessary. That cost per client is part of the scaling process. The question isn’t whether you can acquire clients, but if you can do so in a way that positively impacts long-term growth.

Finally, lead conversion rates average around 12%. This isn’t just a metric, it’s the pulse of your client journey. Every lead that converts represents traction, momentum, and the chance to propel your firm forward.

So here’s the bottom line: Digital transformation isn’t just adding data points to your strategy; it’s about crafting a clear flight plan in the midst of endless noise. Benchmarks give us the power to refine, to adapt, and to navigate precisely. The true power in private equity digital transformation lies in how well you use data to elevate decision-making, growth, and resilience.

Are you ready for takeoff?

My Favorite Finds This Week

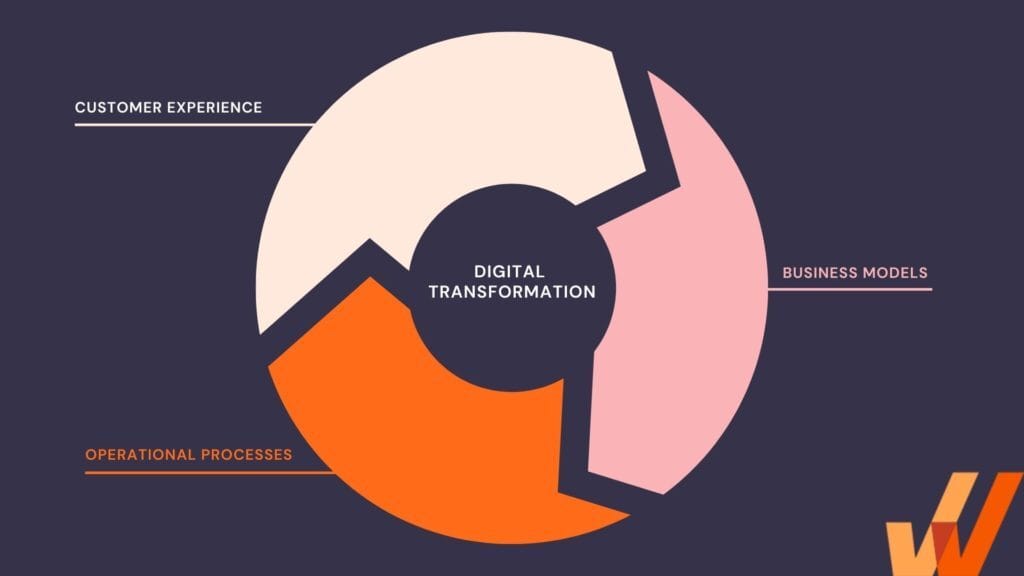

Digital Transformation: A Comprehensive Guide |

40 Lead Generation Ideas: Innovative Ways to Capture Prospects |

PPC Trends to Watch in 2024 |

Are you enjoying the content we’re sharing from BoardSpire?

I’d love to hear from you, so I’d appreciate your feedback in this quick poll:

How do you like the BoardSpire newsletter? |

Thank you!

David