- Boardspire

- Posts

- Private Equity in 2025: Looking Ahead

Private Equity in 2025: Looking Ahead

From AI’s impact on M&A to key private market trends, here’s what’s shaping the year ahead.

Hey, it’s David

Private equity is evolving fast, and staying ahead means understanding the forces shaping deal flow, valuations, and market strategies. This week, we’re diving into:

PE’s 2025 Playbook – Market shifts, sector trends, and where the smartest investors are focusing.

AI in M&A – How artificial intelligence is streamlining transactions and changing due diligence.

Unlocking Liquidity – The power of dividend recapitalization in PE-backed firms.

Let’s get into it.

But before that, a quick word from our sponsor

Cross Keys Capital:

My Favorite Finds This Week

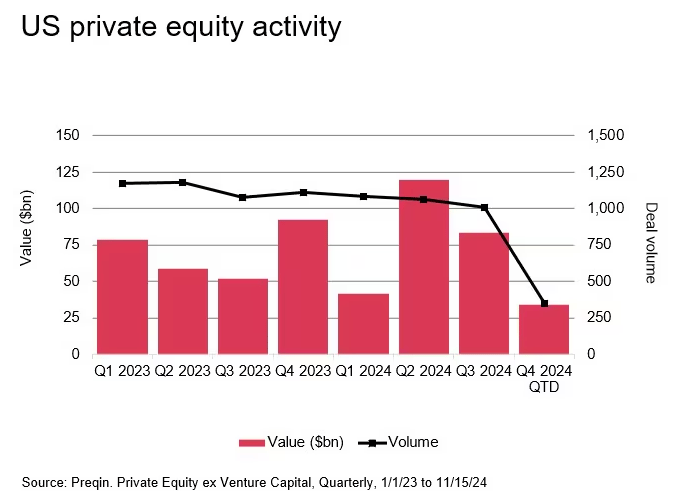

Private Equity Deals Outlook 2025 |

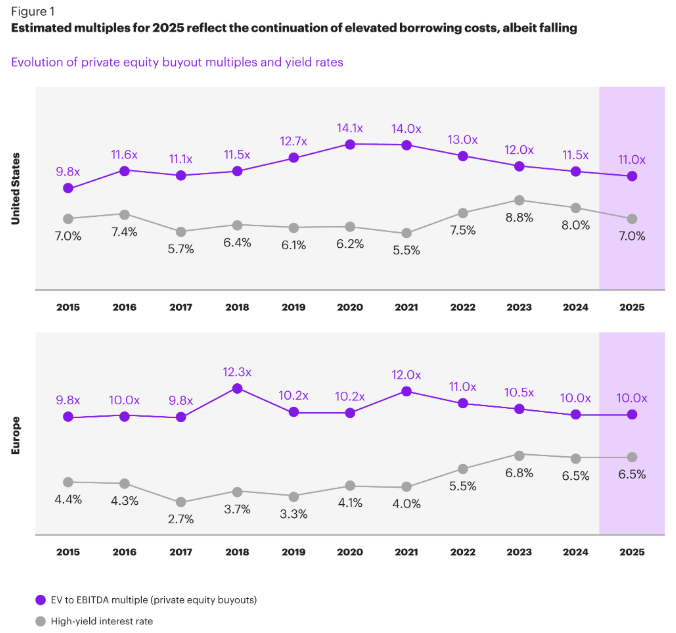

Private Markets: Key Trends & Strategies for 2025 |

The 2025 Outlook for Private Equity |

AI’s Impact on M&A Transactions |

The Power of Dividend Recapitalization in Private Equity |

Are you enjoying the content we’re sharing from BoardSpire?

I’d love to hear from you, so I’d appreciate your feedback in this quick poll:

How do you like the BoardSpire newsletter? |

Thank you!

David