- Boardspire

- Posts

- Private Equity’s Next Moves: Key Trends for 2025

Private Equity’s Next Moves: Key Trends for 2025

From shifting deal strategies to investor pushback, how private equity is evolving this year.

Hey, it’s David

Private equity is at a turning point. As firms recalibrate deal strategies, investors push back, and liquidity challenges reshape the secondary market, the industry is entering a new phase. This week, we’re diving into:

The 2025 Private Capital Outlook – What’s driving deals, exits, and valuations.

PE Deal Trends – The sectors and strategies shaping the year ahead.

Investor Pushback – Why LPs are rejecting changes to protections.

The Secondaries Surge – How interest rate shifts are driving more secondary deals.

Digital Disruption – How AI and data are reshaping PE.

Let’s break it down.

My Favorite Finds This Week

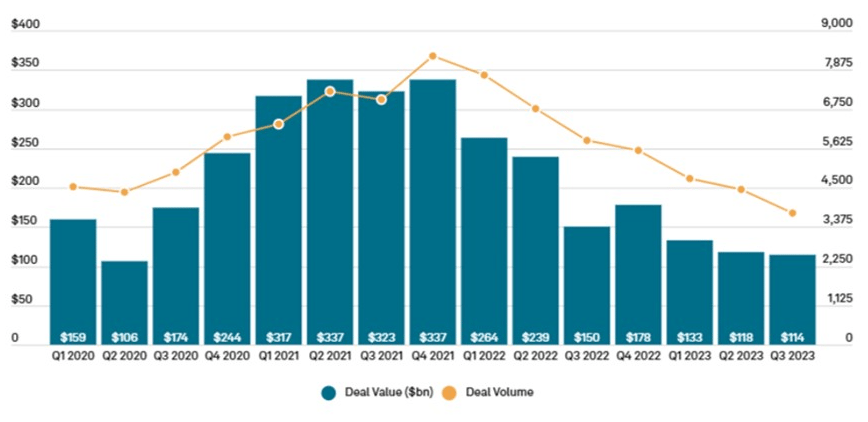

| PE Deal Activity: What to Expect in 2025PwC unpacks the key trends in private equity deal flow, sector focus, and how firms are adapting to the evolving market. Read more |

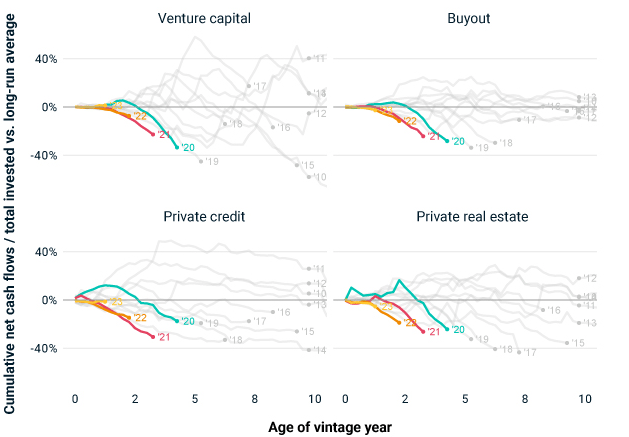

| The 2025 Private Capital Outlook: Deals, Exits & ValuationsMSCI outlines the forces shaping private capital markets, from valuation shifts to exit strategies and investor sentiment. Read more |

| The Evolution of Private Equity in the Digital EraTechnology is reshaping private equity; AI, data analytics, and digital transformation are now core to deal strategy. Read more |

| PE Faces Pushback on Stripping Investor ProtectionsPrivate equity firms are trying to rewrite the rules, but investors aren’t having it. With LPs pushing back against changes to investor protections, the balance of power is shifting. Read more |

| Navigating Private Equity Secondaries in a Shifting Rate EnvironmentWith interest rates in flux, secondary markets are becoming a critical liquidity tool for PE firms. What does that mean for deal flow? Read more |

Are you enjoying the content we’re sharing from BoardSpire?

I’d love to hear from you, so I’d appreciate your feedback in this quick poll:

How do you like the BoardSpire newsletter? |

Thank you!

David