- Boardspire

- Posts

- The Deal Safeguard Smart Buyers Never Overlook

The Deal Safeguard Smart Buyers Never Overlook

In M&A, trust is critical... but is it enough to protect your investment?

Hey, it’s David!

Buying or selling a business is one of the biggest financial decisions you can make, and with big decisions come big risks.

Yet, there’s one safeguard that can make all the difference and it’s often misunderstood.

…I Should Have Purchased Title Insurance Before I Bought This Plane

On a recent flight, I listened to the Seller of a business complain about being required to set up an escrow account as part of their purchase agreement.

He said, “I’m honest, why do I need an escrow?” So, I asked him: “If you were buying a business, would you spend millions without one?”

His response? “No way in hell!”

This highlights an important point: Escrow accounts are not about mistrust; they’re about protecting both Buyers and Sellers from potential risks. And when you understand what’s at stake in an M&A deal, it becomes clear why escrow is essential.

But What If There Is A Breach?

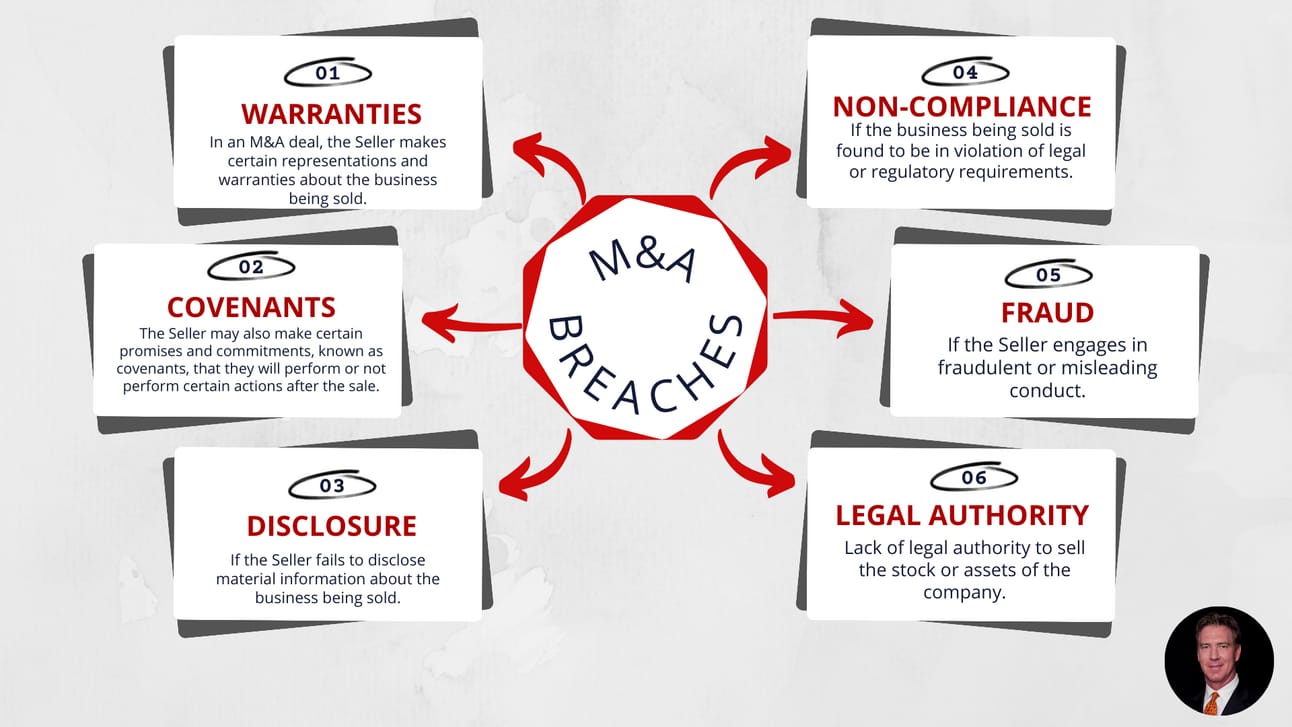

There is always a possibility that a breach may occur in an M&A deal that could give the Buyer the right to go against the escrow account:

Why Escrow Matters in M&A

In most M&A deals, the Buyer wants assurance that the business they’re purchasing is exactly as represented. At the same time, the Seller wants to be confident they’ll receive payment once all terms are fulfilled. This is where escrow accounts come into play.

Escrow provides protection against common risks in M&A, such as:

Warranties: Ensuring that all representations and warranties about the business are accurate.

Covenants: Verifying that agreed-upon actions (or restrictions) are followed after the sale.

Disclosure: Addressing any failure to disclose material information about the business.

Non-Compliance: Covering legal or regulatory violations discovered post-sale.

Fraud: Guarding against fraudulent or misleading conduct.

Legal Authority: Confirming the Seller has the right to sell the stock or assets.

Without escrow, Buyers risk inheriting unresolved issues, and Sellers face uncertainty over receiving their payment.

The Bottom Line: Escrow as The Safety Net Against Breaches

An escrow account is more than just a contractual formality…it’s a safeguard that ensures accountability and trust in an inherently high-stakes process. Whether it’s protecting against undisclosed liabilities or verifying post-closing obligations, escrow mitigates the risks that can derail a deal.

Would you sell or buy a business without this safety net?

Are you enjoying the content we’re sharing from BoardSpire?

I’d love to hear from you, so I’d appreciate your feedback in this quick poll:

How do you like the BoardSpire newsletter? |

Thank you!

David