- Boardspire

- Posts

- Uncovering Liquidity in High-Stakes Deals

Uncovering Liquidity in High-Stakes Deals

Cash conversion clarity. Key metrics for evaluating financial strength in leveraged acquisitions

Hey, it’s David

At Boardspire, we’re here to bring you strategic insights that matter most for business acquisitions, growth, and navigating successful exits.

In this issue, we’re focusing on cash conversion, a critical metric for understanding how effectively a business turns revenue into ready cash.

Whether you’re on a plane or in the boardroom, understanding the cash conversion cycle can make or break a deal, especially when debt or leverage is in play.

You’ll also find key insights on these topics:

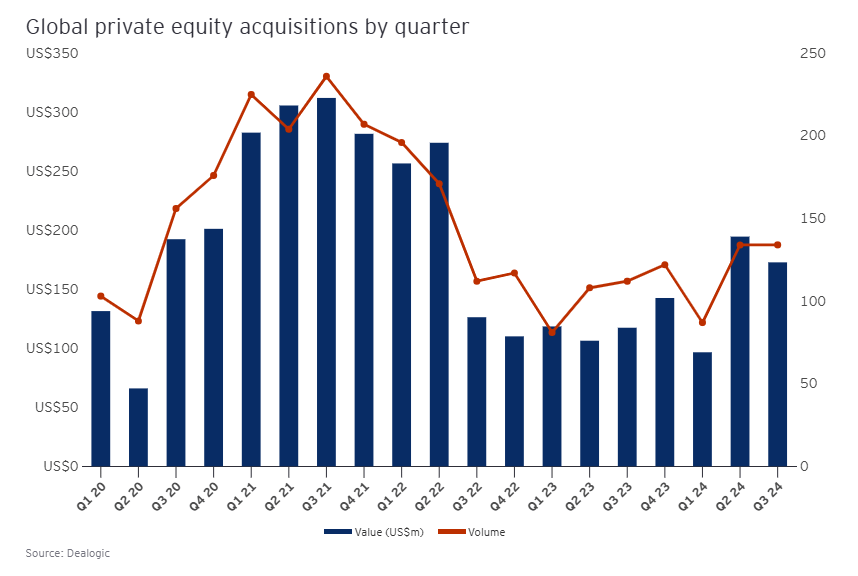

Private Equity Trends – Q3 insights on deal flow and sector activity in private equity.

Roll-up Strategies – How consolidation can drive growth by merging smaller companies into competitive leaders.

And more...

My Favorite Finds This Week

Private Equity Pulse: Key Takeaways from Q3 2024 |

Differentiation: The Key to Success in 2025 |

Roll-up Strategy: Driving Growth in Private Equity |

Portfolio Monitoring and Optimization |

M&A from the plane…The in-flight meal just arrived, but where’s the drink cart?

An in-flight meal without a drink leaves you feeling like something’s missing… just like an M&A transaction without understanding cash flow efficiency.

Many buyers overlook the target company’s cash conversion cycle, yet knowing how quickly and effectively the business turns assets into cash is essential, especially when acquisition debt is involved.

So, what is Cash Conversion?

Cash conversion refers to the process of converting the company's assets into cash, or the ability of a company to convert its sales or revenue into cash or cash equivalents.

In other words, it is a metric that measures how efficiently a company converts its sales into cash.

A high cash conversion rate indicates that a company is effectively collecting payment for its sales and that it has a strong financial position. A low cash conversion rate may indicate issues with receivables or difficulty collecting payment from customers.

Cash conversion can be measured using the following metrics?

Days Sales Outstanding (DSO): This measures the number of days it takes for a company to collect payment for its sales. A lower DSO indicates a more efficient cash conversion process.

Cash Conversion Cycle (CCC): This measures the length of time it takes for a company to convert its inventory and receivables into cash. It is calculated by adding the number of days it takes to sell inventory (DSI) to the number of days it takes to collect accounts receivable (DSO) and then subtracting the number of days it takes to pay off accounts payable (DPO). A lower CCC indicates a more efficient cash conversion process.

Operating Cash Flow (OCF): This measures the cash generated from a company's operations. It is calculated by subtracting operating expenses from operating revenues. A high OCF indicates a strong cash conversion process.

Return on assets (ROA) or Return on Equity (ROE): These ratios indicate how efficiently a company is using its assets or equity to generate cash. A higher ratio indicates better cash conversion.

It’s essential to use these metrics alongside other financial indicators to fully understand a company’s cash conversion and financial health.

Cash is the lifeblood of any business; a company that struggles to convert sales into cash may face challenges in meeting obligations like acquisition debt and investing in growth.

In the world of acquisitions, cash conversion isn’t just a metric, it’s the pulse of a company’s financial health. Monitoring these ratios ensures your next move is grounded in data, aligning every step with growth and stability.

Are you enjoying the content we’re sharing from BoardSpire?

I’d love to hear from you, so I’d appreciate your feedback in this quick poll:

How do you like the BoardSpire newsletter? |

Thank you!

David